This means the bulls are not being able to create higher highs and, at the same time, the bears are finding it difficult to bring about lower lows. This means an absence of significant buying/selling pressure, which could break the previous bars’ high or low. The market is consolidating itself, after a large directional trend.

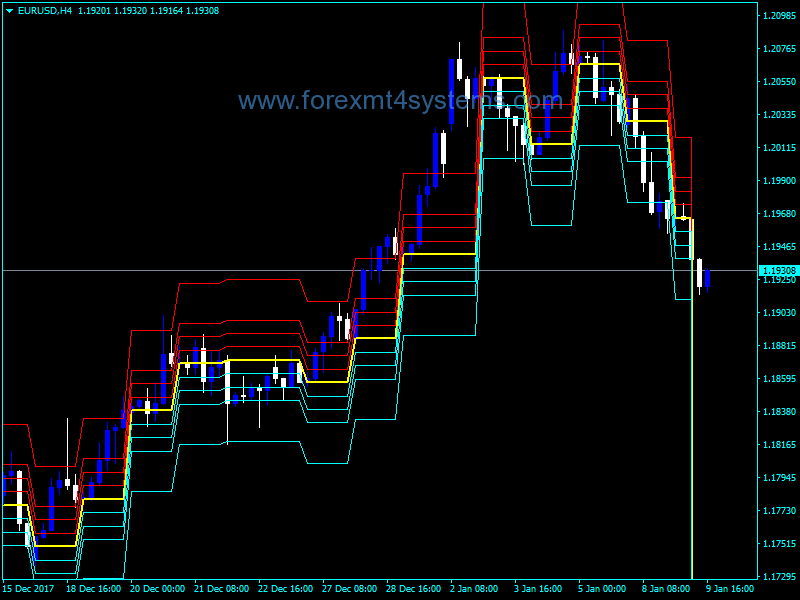

Since the Inside candle on the chart is a sign of a consolidating market, we can draw a horizontal support and resistance level around this range in anticipation of a future breakout. When the price exits the inside bar range, we expect that the price action will continue to move in the direction of the inside bar breakout. As with any chart pattern, though, inside bar trading isn’t perfect.

This is true whether we’re inside bar forex an inside bar, pin bar or wedge breakout. Each and every strategy needs to be accompanied by a favorable risk to reward ratio. A period of consolidation within a broader trend is the market’s way of regrouping. In an uptrend, the consolidation is triggered when longs decide to begin taking profits . This causes the market to pullback, where new buyers step in and buy, which keeps prices elevated.

#4: Inside Bar Trading Strategy

The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk, including the possible loss of principal. The inside pattern indicates a smaller trading range in relation to previous days’ intraday trading ranges. Most forex traders are trend traders and follow the trend using… The core of the technical analysis is to identify the trend… The inside candlestick should be smaller in range as compared to the mother candlestick.

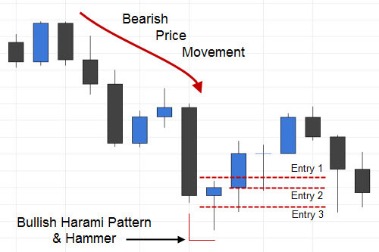

We will not accept liability for any losses or damages, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. We first look to establish what the direction of the dominant trend is; in this case the trend was down. Next we are going to look for significant horizontal levels in the market, or areas were price has bounced from numerous times; I refer to such areas as “hot points” in the market.

Inside Bar Indicator

It shouldn’t approach the size of a mother candlestick. Most traders neglect to learn the basics before trading. I have been looking at inside bars at locations that you have mentioned; support, resistance, and trend continuations and fine them to be rather strong and fascinating little creatures. You mention that the third candle was your confirmation candle , however you mention that you took a short position around the middle of the confirmation candle.

Notice on the chart below I have marked a shooting star on the AUD/USD Forex pair with a circular highlight. Notice that it is at the 61.8% Fibonacci retracement level from the massive move lower, and that is an area where we have already seen the price fall from. The candlestick that is circled started a massive move toward the bottom of the Fibonacci retracement tool. Common strategies incorporate market bias analysis, chart patterns, and volume analysis into the mix.

This article discusses one of the most sought after technical analysis… So, if I read this correcly; after an inside bar, the trade can go one of two ways – either with the prevailing trend or against it? Am I being thick – but what is the point of knowing that? Really thoughtful of you to share such helpful information. The inside day with narrow range is an inside candle which also has the smallest day range among the last four days.

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

This pattern continues for days, weeks or even months until new buyers are able to once again outweigh the sellers and drive the market higher. The inside bars in the chart above formed on the GBPJPY daily chart in a choppy market. This sideways price action represents consolidation, which is what you want to avoid when evaluating an inside bar setup.

Continue Learning

With a large enough sample, say two hundred theoretical trades, you should have an idea of the typical percentage of wins versus losses. You would also do well to understand the potential distance that a market may typically move after forming whatever setups you choose to use. These setups should also have a clear-cut signal determining when you will exit the trade. I don’t recommend fancy indicators to traders, but I recommend indicators based on price action.

The stop loss would normally be placed on the other side of the inside bar pattern. Placing an entry to sell, if the previous low is broken . 45,000 students in over 153 countries have already put themselves on the path to consistent profit. You will also receive detailed logic and script definitions for use with the TC2000 software platform. This means you will be able to find and analyze new trading opportunities quickly. If you are serious about making money trading, you are about to take a journey that will change your life.

I also recommend sticking to inside bars that are in-line with the daily chart trend as continuation signals until you have fully mastered trading them that way. In the example below, we are looking at trading an inside bar pattern against the dominant daily chart trend. In this case, price had come back down to test a key support level , formed a pin bar reversal at that support, followed by an inside bar reversal. Note the strong push higher that unfolded following this inside bar setup. As with all things related to technical analysis, you need to pay close attention to support and resistance. Where impulsive candlesticks can become particularly interesting and profitable is when you see support or resistance level broken by a long candlestick.

Tech View: Nifty forms Inside Bar candle on weekly charts. What traders should do next week – Economic Times

Tech View: Nifty forms Inside Bar candle on weekly charts. What traders should do next week.

Posted: Fri, 06 Jan 2023 08:00:00 GMT [source]

Learn how to trade forex in a fun and easy-to-understand format. Strategy, however, is only useful if you understand the mechanics of price and how to interpret Market Dynamics in a price chart. Mastery of the INSIDE BAR pattern is a skill set that every screen trader should possess. The inside bar pattern highlights whether the market prices are consolidating or pausing. Wait for a breakout of the inside bar and trade its failure.

Does Price Action in Trading Really Work?

Then open a sell trade and place stop-loss a few pips above the swing high. Here I have explained a simple trading strategy using the confluence of support or resistance zones with the inside bar indicator. In the chart below, we can see an example of a good inside bar reversal signal. Of critical importance here, is that the inside bar formed at a key chart level, indicating the market was hesitating and “unsure” if it wanted to move any higher. We can see a decent downside move occurred as price broke down past the inside bar’s mother bar low.. Any opinions, news, research, analysis, prices, or other information contained on this website does not constitute trading or investment advice.

Beginner’s Guide to Stock Chart Patterns • Benzinga – Benzinga

Beginner’s Guide to Stock Chart Patterns • Benzinga.

Posted: Fri, 30 Sep 2022 07:00:00 GMT [source]

If I’m asked about what is the most interesting part for inside bar trade, my answer is “trailing”. 1st kick is only for risk management purpose to make me able to deposit the risk to other trades, the outstanding risk-reward ratio is about the other half of the positions. The other half is very important so I need it to run as much as possible, so I NEVER put… Learn the exact chart patterns you need to know to find opportunities in the markets. No pattern is the holy grail of trading, and the inside bar pattern, like many other classical chart patterns, has strengths and weaknesses.

What Does Price Action Mean?

The worst time to trade it is when a market is in a range. You are actually taking advantage of traders who are “trapped” from the long breakout. And this is why you cannot break above the 10-period moving average. This orange line over here is the 10-period moving average. The second is when the price is respecting the 10-period moving average.

An inside https://g-markets.net/ is actually a single bar that is completely inside the preceding bar. For clarity, the entire price action of the inside bar are covered and contained within the range of the previous bar. In the following illustration, we can see that the high of the bar B is lower than the high of the bar A , and the low of the bar B is higher than the low of the bar A. As you can see in the chart above, all Inside Bars bouncing near the red rising channel were profitable – considering that we are taking the bullish breakouts here only. If you trade using the daily chart, you need only a few minutes each day to check your chart, place your pending order and walk away.

When looking at a candlestick chart, you can spot an inside bar indicator when a given bar’s high and low are fully contained by the bar directly preceding it. This signals a narrowing of price action that can be used to predict upcoming movements outside of this range. Of retail investor accounts lose money when trading CFDs with this provider. The only thing that matters is whether the mother bar is bullish or bearish.