Contents:

That is chargeable or no, that’s not chargeable. And to go through all those steps and then come out with a good process and a good set of charges. The most of the clinicians are a good portion of the clinicians probably report to a CNO in a hospital and they do care. They are the first one to tell you, though, I don’t care about charges. I care about patient care, but really they mean that when they’re with their staff, but then when they’re with the finance team, then they do care because they do want to hire more nurses. Well, margins and the way the hospitals operate are so tight right now.

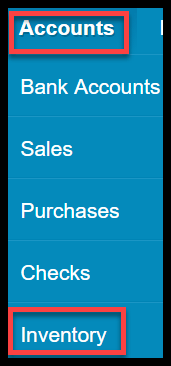

The Income column displays this information, as displayed below. You can view a sample of the Journal Entries report below. Review the status and log for each payment in the Adyen Customer Area.

A lot of times they know they have issues and that’s why they pull in companies like ours. And what they, what they’re shocked about is to the extent that they have it, because, they hire people who they feel like have the knowledge that they need to work their departments. And then, then you get a third party in there to help so long, what about this?

Daily Reconciliation Reports

Fill out the form to receive the guide as a PDF. ClosingVue by E-Closing is the easiest title production system to implement and learn with training averaging less than three hours. If you’ve been using the same software for years and would like to give your company a technology boost, get a one-on-one demo! A demo of ClosingVue may be the best investment you’ve made in your business in a long time.

So, I mean, there’s that whole side of the coin too, that hospitals have to understand and be aware of. When you guys go to hospitals, are you typically seeing issues in charge capture in general? On the front end, expectations should be set – a common misinterpretation of an automated system is that it can do everything without any direction. Undercharging means that hospitals aren’t being paid sufficiently for their services. That revenue that is missed can’t go back into the hospital’s system as a future investment towards other systematic changes or labor.

Why Is It Important to Reconcile Charges?

Because the acquiring is outside of Adyen, the information used to generate this xero pricing, reviews, features is provided by external acquirers. If you do so, you need to skip this step and reconcile those transactions separately. This guide shows how to reconcile the costs of transactions and the payout amounts in a single payout batch on a transaction level. If you accept credit card installment payments in Brazil, you need to additionally follow these instructions. They’re so in love with these papers that they’ve been using for 10 years, that’s the way we’ve always done it, that they don’t want to change this.

I have enough things to worry about, I’m glad they have this service which frees up my team to deliver better service to renters and owners. It could be the case that transactions don’t always run through your bank account solely. Be sure to make note of those and keep a record so everyone is aware of these transactions.

Obtain a daily reconciliation form on which to document the cash reconciliation. Reconcile Daily is a simple service that helps you accurately balance your books and keep you on track, so you have peace of mind knowing you’re 100% compliant. Many property management companies are unsure if their trust accounts actually match what’s in the bank. There is no standard way to perform an account reconciliation. Monthly reconciliation leaves you playing guessing games with your cash balance.

Automation of data import, matching, and reporting

Drill-down reports are provided for processing fees, late and/or service fees, and credit card pass thru fees. Besides that they’re awful at it, but out of the hundred that I’ve been to, I haven’t met one. Maybe, maybe you have for you have, that has done it well is good at charge capture.

There, there’s kind of so many things, what we tried, from at least from a product or solution perspective, I always look at, Hey, what’s the job to be done? We were just talking about if I’m a clinician or I’m a department director, I’ve got to go into my system, pull my reports of all my clinical activity that might be happened the previous day. Then I go look at all the bills that are generated and I’ve got these reports and I’m matching them up. I look at what needs to be automated, not as, Hey, what’s good automation, but what’s the job to be done. How do I help the end user do their job more efficiently with using technology or using automation? So we, we kind of focus on those types of things to say, Hey, this, if I’m doing this manually to reconcile, can I use technology or automation to do that for me?

Does it, does that medical record fall in line with them? I’m kind of feeding a little bit here, so I’m just curious, like. Without the properly trained staff, your automated software might as well be useless. Each entry should match a deposit on your bank statement.

Marcos offers reconciliation; critics demand atonement – INQUIRER.net

Marcos offers reconciliation; critics demand atonement.

Posted: Sun, 26 Feb 2023 08:00:00 GMT [source]

I know HFMA has a number of like 1% of revenue, but what we’ve seen in our clients, in our data, it’s the revenue wise, not the clinical is it’s been around two or 3%, at least. It’s not an easy process to set up and it’s, and it’s ever changing. That’s the other thing, Medicare is ever, ever, ever, ever changing on us. Every quarter we get an, an update for Medicare, if something we can do now, or we can’t do.

Here’s what you can do because it’s going to change. So you have to always keep up with it and make sure that you’ve built out your system correctly. Could be, that could be that they just don’t know where the finalization of the documentation is. And what is the last step I have to do to ensure that that charge drops?

Since you’re not looking through a month’s worth of transactions, it makes the process as quick and painless as possible. The Nostros tab lists all the bank accounts in your entity, and their End of Day currency-specific balance. You can use this tab to reconcile the EOD balance with the actual amount you have in your bank accounts. To access the Nostros tab, navigate to Nostros in the top-menu. Our clients work with hundreds of different banks.

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

Get answers specific to your business that get to the root of the problem. If it has been less than an hour since you did the close of day or shift, your data may not be in yet. Fields the largest retail network in Slovakia offering top-quality motor fuels and lubricants as well as other customer services such as shops, gastro service, car wash, and others.

When you perform https://bookkeeping-reviews.com/ bank reconciliation, you’ll be able to know that records are up-to-date and right. If they aren’t, you’ll be able to pinpoint the issue or exception. Reconciliation is an accounting process that compares two sets of records to check that figures are correct and in agreement.